Introduction

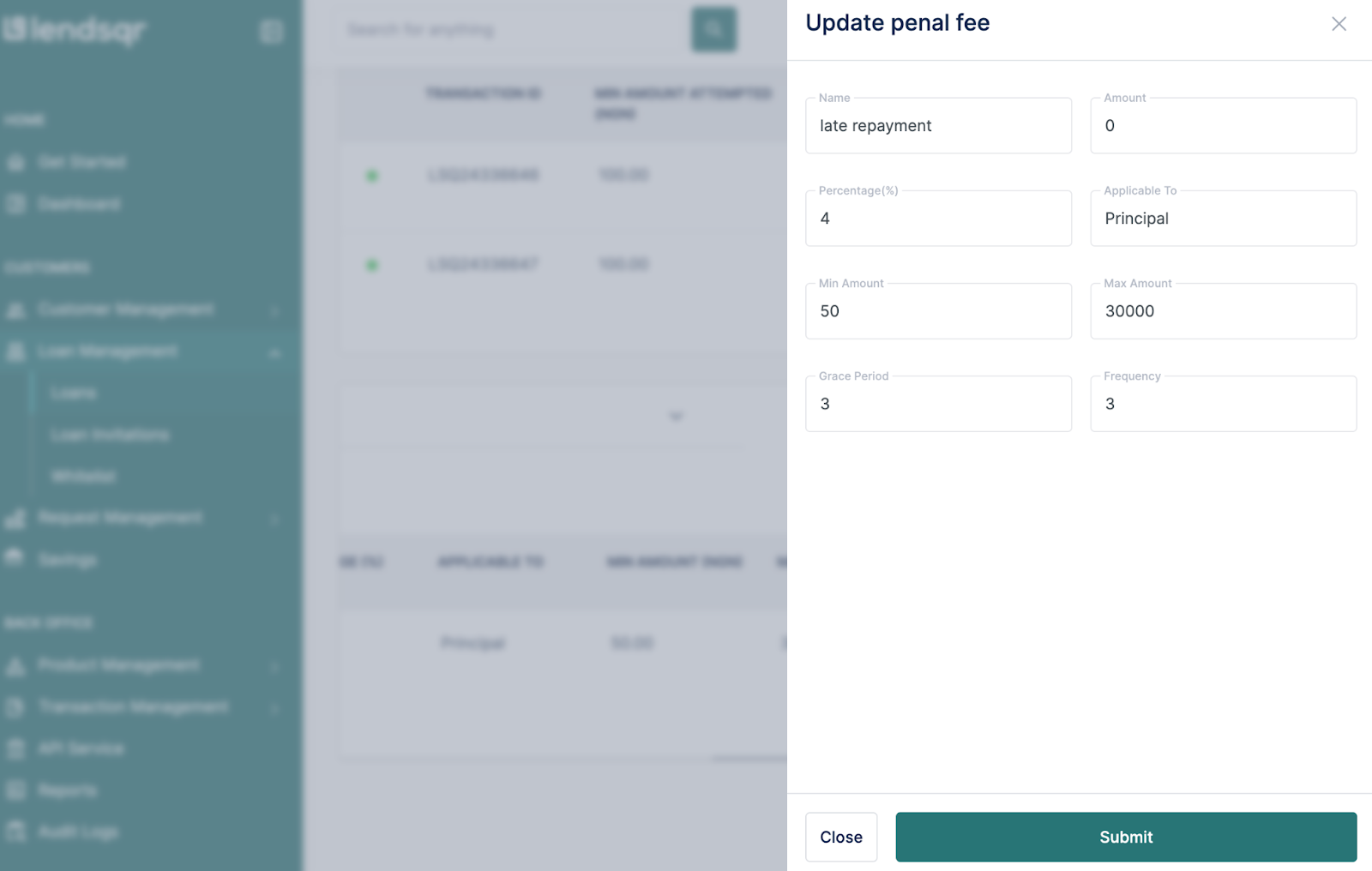

Penalties play a vital role in loan management by encouraging timely repayments and adherence to agreed terms. They are typically applied for delays, missed payments, or other breaches of the loan agreement. With the Penalty Calculation feature, you can access a detailed breakdown of any penalties associated with your customer's loans. This feature allows lenders to edit the penalties attached to approved loans, and in situations where incorrect penalty fees have been added, they can be updated accordingly.

Definition of terms in penalty calculation

Name: The name of the penalty.

Amount: The fixed amount of the penalty.

Percentage: The percentage of the applicable amount that contributes to the penalty.

Applicable To: Whether the penalty is calculated based on the principal or principal + interest

Min Amount: The minimum amount of penalty that can be charged.

Max Amount: The maximum amount of penalty that can be charged.

Grace Period: The number of days after the due date before a penalty is applied.

Frequency: How often the penalty is applied

How to view and edit penalties calculation on your loan request

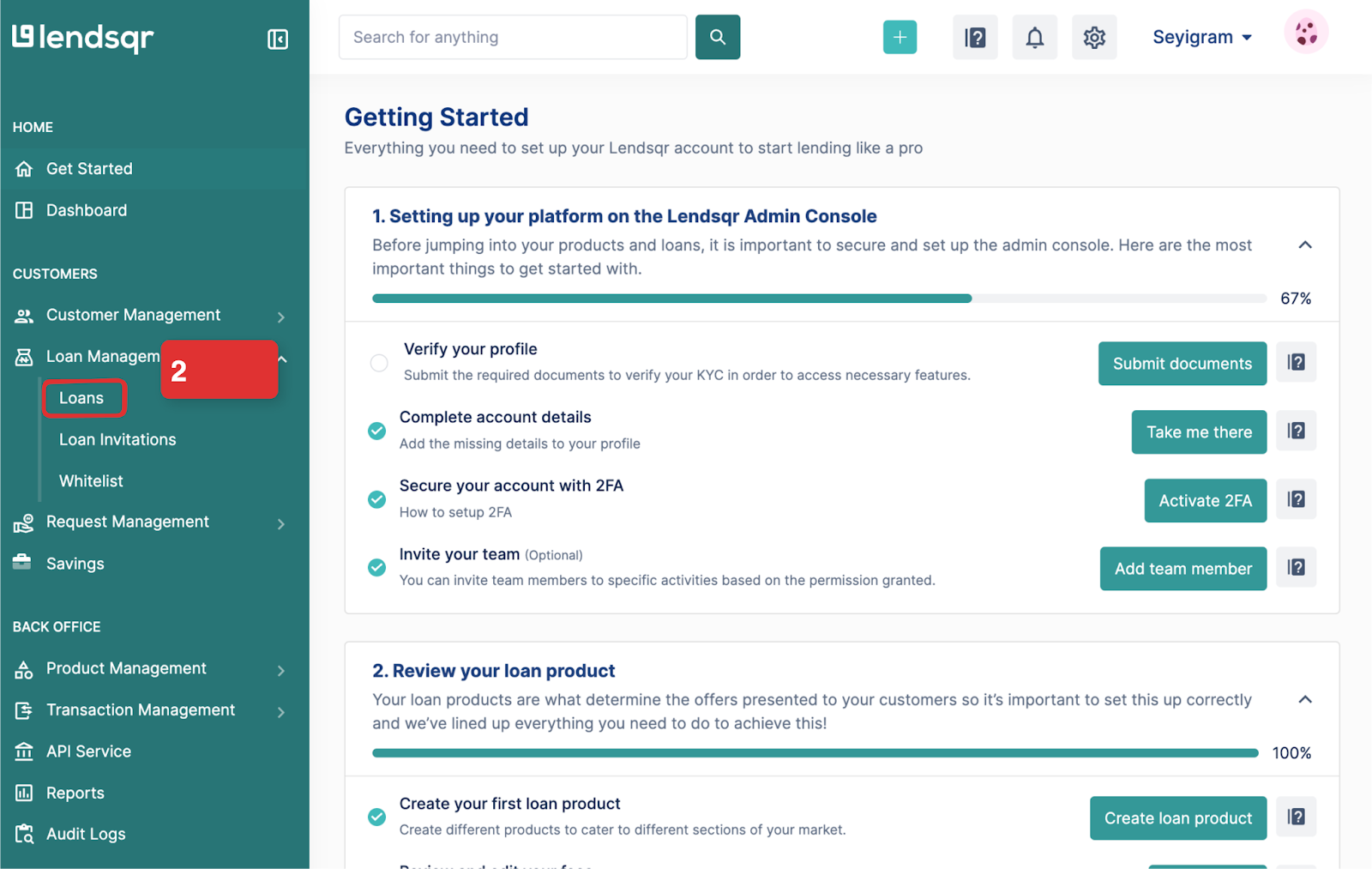

Navigate to the "Loan Management" tab in the side navigation menu.

From the dropdown menu, click on "Loans".

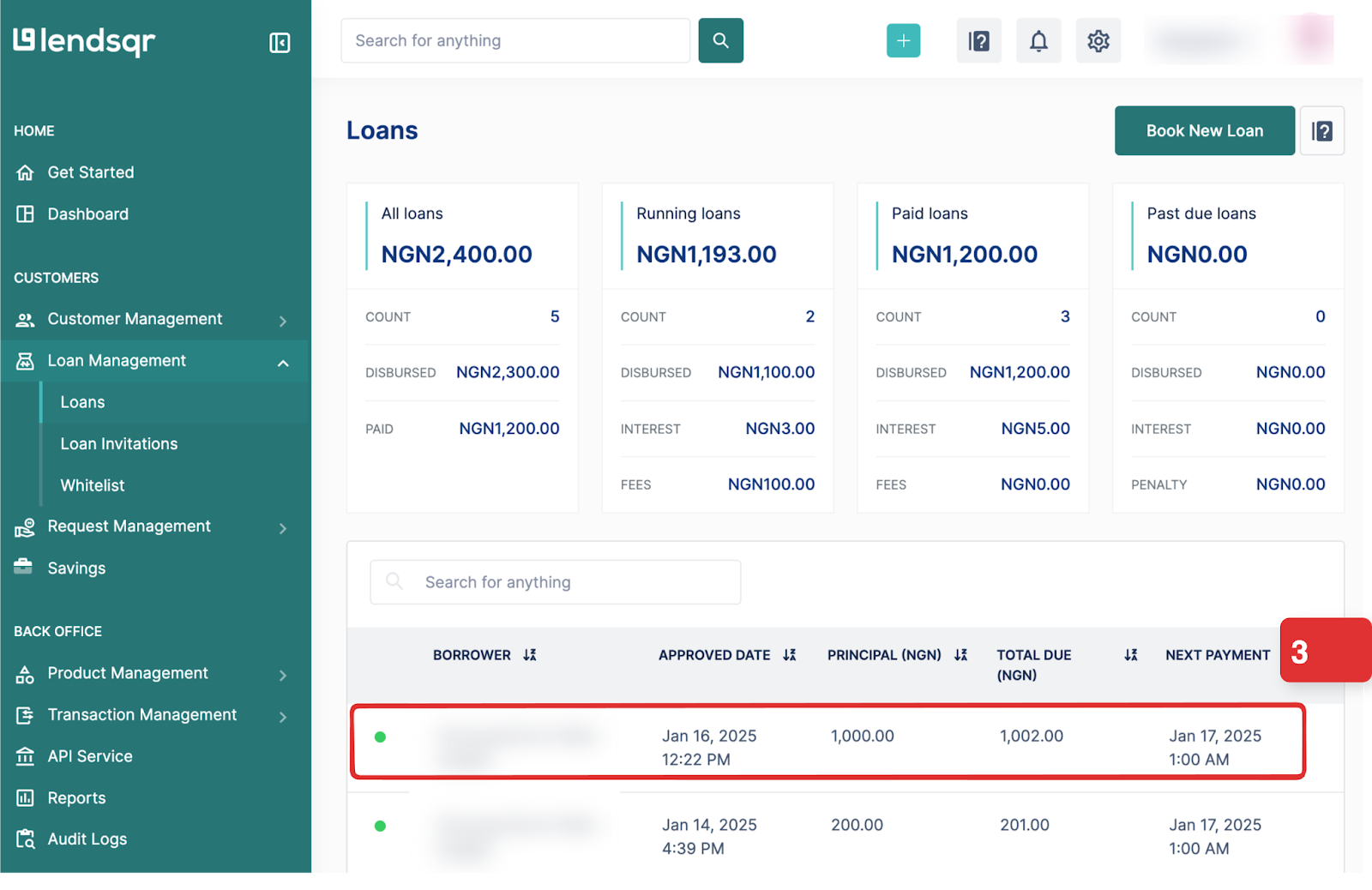

Click on the loan you want to view.

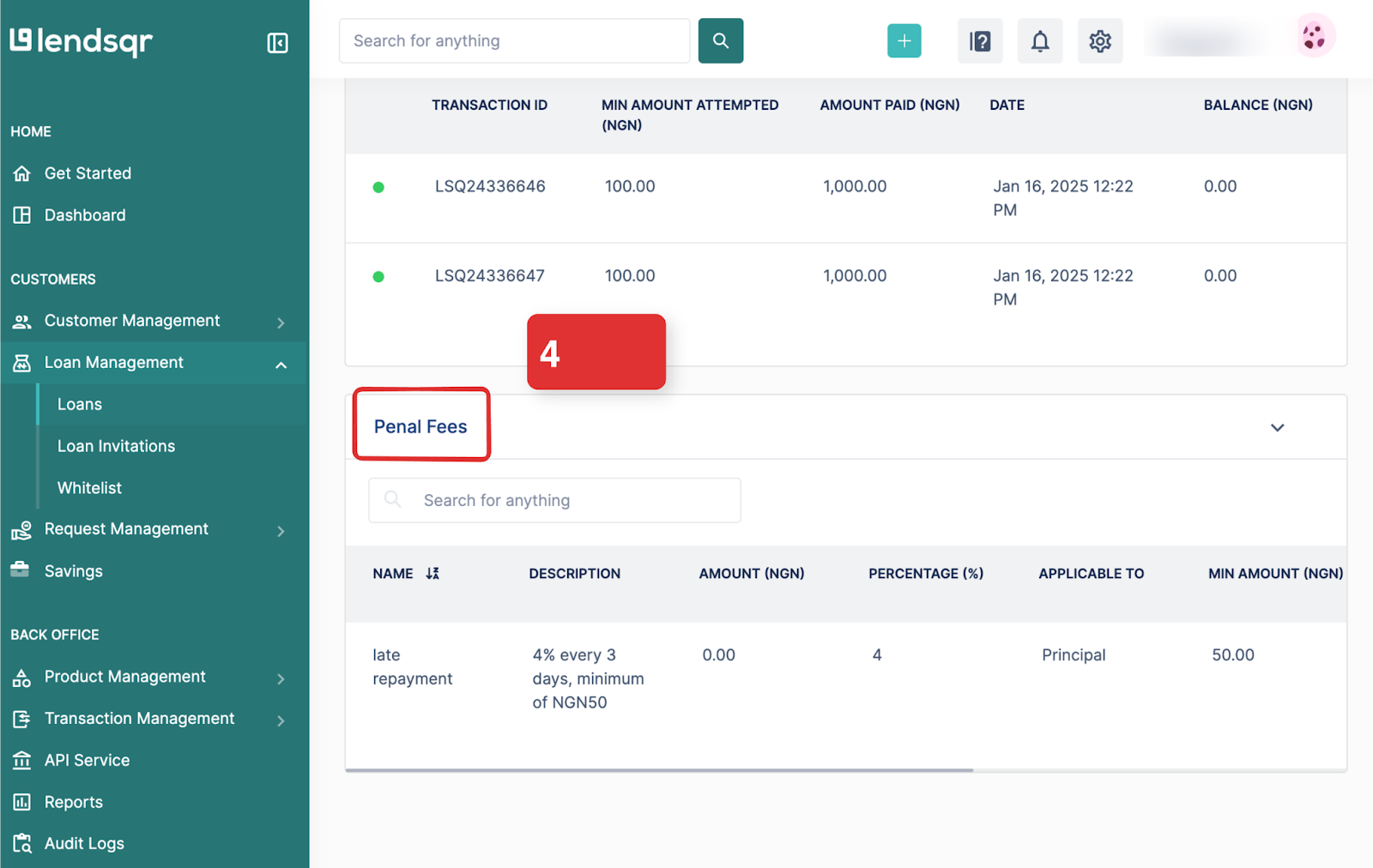

Scroll down to the section "Penal Fees".

Click on the edit button to update the penal fees.